- Macro Monday

- Posts

- Be Wary Of The TACO Trade!

Be Wary Of The TACO Trade!

The Macro Institute's Weekly Economic Primer

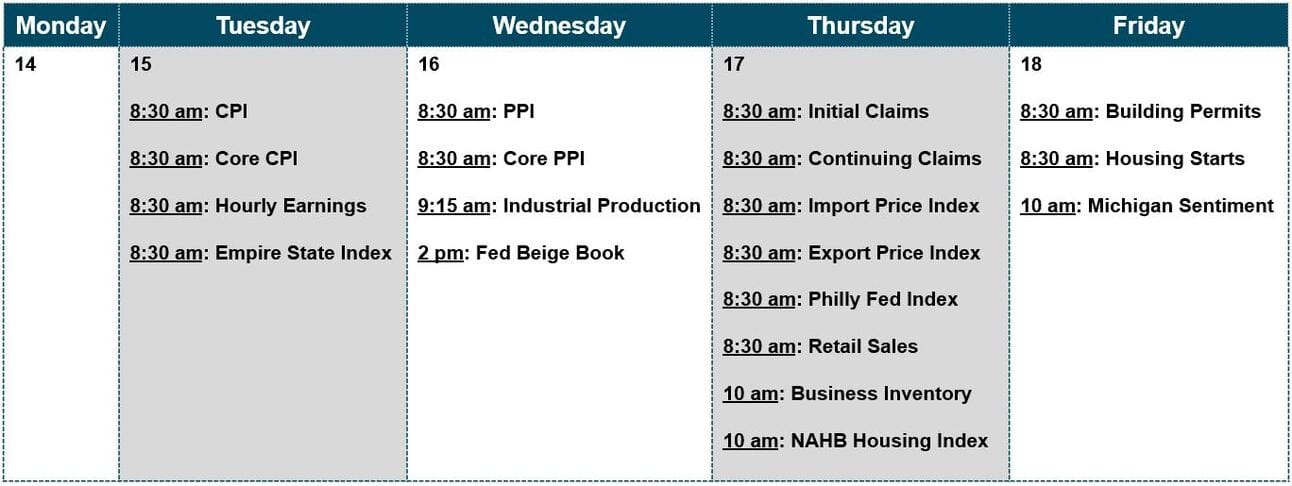

There’s a full slate of key data on deck this week. Hopefully it will bring some clarity to the economic and market outlook. We’ll get the first regional PMI readings for July, with the Empire Fed Index out on Tuesday and the Philly Fed Index following on Thursday. Also on Thursday, the NAHB housing market index is released, and Friday brings the latest read on consumer sentiment via the University of Michigan survey.

We’ll be looking closely for signals regarding employment and inflation, which are still the two most consequential themes driving markets. In that vein, Tuesday’s CPI report and Average Hourly Earnings data will be front and center for us. Historically, CPI and Hourly Earnings have shown a strong correlation, and lately that relationship has been even tighter.

Put simply, a tighter labor market tends to be inflationary through rising wages. Of all this week’s data, Hourly Earnings could end up being the biggest market mover.

The Macro Week In Review

The Real Traders Aren't on CNBC

Your current options for finding stock trades:

Option 1: Spend 4 hours daily reading everything online

Option 2: Pay $500/month for paywalled newsletters and pray

Option 3: Get yesterday's news from mainstream financial media

All three keep you broke.

Here's where the actual edge lives:

Twitter traders sharing real setups (not TV personalities)

Crowdfunding opportunities before they go mainstream

IPO alerts with actual timing

Reddit communities spotting trends early

Crypto insider takes (not corporate PR)

The problem? You'd need to be terminally online to track it all.

Stocks & Income monitors every corner where real money gets made. We send you only the actionable opportunities. No fluff, no yesterday's headlines.

Five minutes daily. Walk away with stock insights you can actually act on every time.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

The Macro Week Ahead

✉️ You’ve Got Mail

Just ahead of the original July 9th tariff-pause deadline, President Trump kicked off the next chapter of the trade saga by issuing formal letters to many nations outlining their new reciprocal tariff rates set to take effect on August 1st. Among the notable numbers: 25% for Japan and Korea, 35% for Canada, and 15–20% “blank tariffs” for most other trading partners. The headline grabber? A 50% tariff on copper. While negotiations are still ongoing, and some countries may receive extensions, the message is clear. Tariffs are back on the table in a big way.

Bloomberg had recently pegged the U.S. effective tariff rate at 13.3%, but these developments suggest that may be an underestimate if negotiations don’t bear fruit. Unsurprisingly, the Economic Policy Uncertainty Index spiked to a one-month high nearing levels last seen around “Liberation Day.” However, market volatility has stayed subdued thus far. The S&P 500 remained relatively flat last week, even brushing up against all-time highs. Investor fatigue around tariffs may be settling in, or perhaps confidence is being bolstered by a dovish Fed and ample monetary stimulus still in the pipeline.

📅 The Week Ahead: From PMIs to CPI

Not every week delivers pivotal macro data, but this one might. Between July’s regional PMIs and June’s inflation data, we’ll get some early clues about how tariffs are flowing through supply chains and influencing price levels, hiring, and capital spending. While one month of data won’t tell the full story, especially given the pre-tariff inventory builds in Q2, the tone of recent data has been underwhelming on growth, and surprisingly soft on inflation.

The action starts with Empire Manufacturing (7/15 @ 8:30 am). We expect more noise than signal in regional PMIs this summer as businesses balance their long-term outlooks with rapid-fire policy shifts. For context, April’s “New Orders Expected in 6 Months” was -6.6 (a GFC-era low), but June roared back to +26. Similar volatility has shown up in the Philly Fed PMI, which also reports this Thursday. We'll be focused on inventory trends, which are key to determining whether we’re entering a true upcycle or just seeing a temporary tariff-driven restocking.

Inflation data hits Tuesday and Wednesday, and expectations are heating up. June CPI is expected to rise +0.2% MoM (headline) and +0.1% (core), while PPI is expected to be at +2.5% (headline) and +2.7% (core). Rising “Prices Paid” components in the PMIs suggest these prints could surprise to the upside.

The Fed has turned more dovish lately, thanks largely to inflation cooling toward the 2% mark. But tariffs could change that calculus. Will inflation driven by trade policy trigger a rate hike? Probably not, at least not right away. The Fed may view it as an exogenous shock. Still, with the odds of a September rate cut dropping from 92% to 64% after the strong July payrolls report, markets are already reassessing. As we’ve said in recent Macro Mondays, investors may have gotten ahead of themselves on rate-cut expectations. Between fiscal curveballs and a labor market that’s tightening again, the second half of 2025 may hold more surprises than most are pricing in. Stay tuned.

Macro Job Board

Seeking a Macro Analyst on a global macro strategy team that focuses on top-down alpha-generating investment insights across the firm’s asset classes. This position will contribute to developing applied economic frameworks and translating macro views to asset allocation strategy across and within the firm’s asset classes.

Responsible for conducting quantitative analytics and modeling projects for specific business units or risk types. Key responsibilities include developing new models, analytic processes, or systems approaches, creating technical documentation for related activities, and working with Technology staff in the design of systems to run models developed.

This position will be a member of a small team globally responsible for conducting analysis of major economies and forming views about their future development. This role will focus primarily on the U.S. but will be expected to cover other economies.