- Macro Monday

- Posts

- Cyclical Strength On The Precipice Of Stimulus

Cyclical Strength On The Precipice Of Stimulus

The Macro Institute's Weekly Economic Primer

The third week of the month usually gives us a “first read” on conditions. Today we’ll see the September Empire Index from the NY Fed followed by the Philly Fed on Thursday. Tomorrow’s NAHB report will round out the leading indicators, giving us an early look at economic momentum for September, and hopefully, some insight into labor market dynamics.

On that topic, Tuesday’s Industrial Production report will update capacity utilization trends, a series that has consistently led movements in the unemployment rate over the decades. The data could either support the case for further upside in unemployment or suggest that a peak is near. Either way, the outcome carries direct implications for the Fed’s path in the coming quarters.

The Macro Week In Review

Earn Your Certificate in Private Equity on Your Schedule

The Wharton Online + Wall Street Prep Private Equity Certificate Program delivers the practical skills and industry insight to help you stand out, whether you’re breaking into PE or advancing within your firm.

Learn from Wharton faculty and industry leaders from Carlyle, Blackstone, Thoma Bravo, and more

Study on your schedule with a flexible online format

Join a lifelong network with in-person events and 5,000+ graduates

Earn a certificate from a top business school

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The Macro Week Ahead

📈 On the Precipice of Stimulus

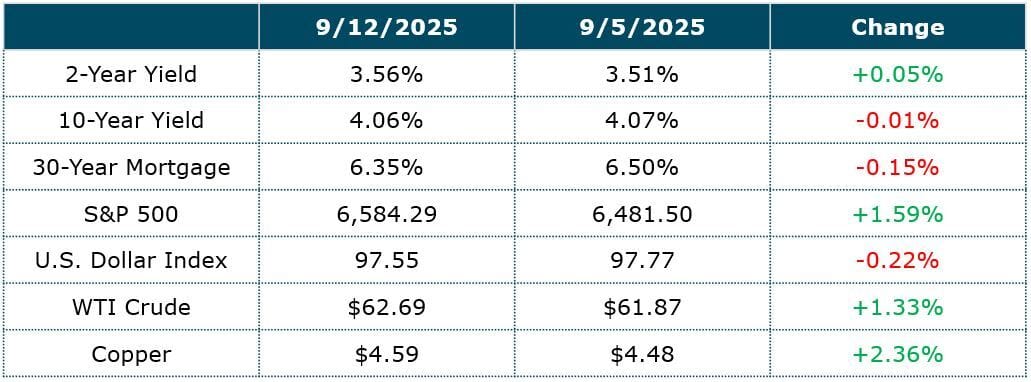

The S&P 500 continues to climb on expectations that a more accommodative monetary policy is coming. The Fed’s rate decision arrives this Wednesday, and a cut of at least 25 bps is effectively guaranteed. Markets will parse the Chairman’s remarks for guidance on how aggressive the path of easing will be into year-end. As of Friday, odds of three consecutive cuts stand at 50%.

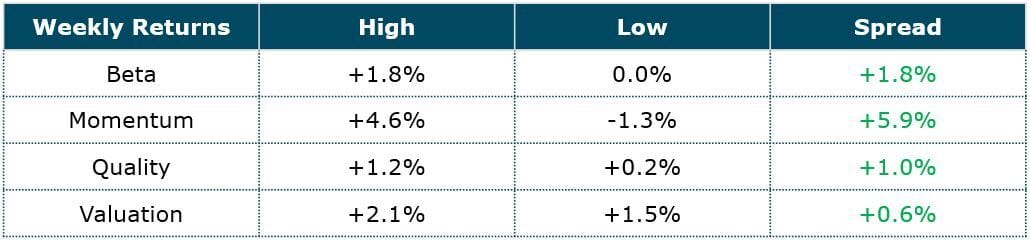

The Fed is leaning heavily on weakening payrolls and softer job openings to justify policy adjustments. Recall that in 2024 the Fed cut rates by 100 bps even with a strong labor market and inflation above target (albeit down from its cyclical peak). The lagged effects of that stimulus are only now filtering through to leading indicators, fueling equity strength and the relative outperformance of cyclical sectors in recent months.

Still, further reductions in the policy rate at a time when growth is improving risk reigniting inflation. Historically, dovish pivots are a preemptive move against deflation. Yet today, Core CPI is running at 3.1% (Aug) and 5-year inflation expectations sit at 3.9% (Sept). These are not levels consistent with easing. The argument for additional rate cuts reflects the Fed’s opinion that labor market weakness outweighs the risk of higher inflation. Expect the Chairman to emphasize protecting consumers’ purchasing power. For equity markets the key takeaway is clear: the potential of easier policy has ushered in a risk-on regime. For now, bad news on employment remains good news for stocks (and rate cut chances).

📆 The Week Ahead

The week begins with the regional Empire Index today at 8:30 am. August’s New Orders component jumped decisively into expansion, though commentary from respondents highlighted ongoing caution about tariff fallout.

Tuesday delivers a trio of coincident indicators: Retail Sales, Industrial Production, and Capacity Utilization. These are useful for gauging current GDP, but less effective as leading indicators. A more forward-looking indicator is the NAHB Housing Market Index, which is also due on Tuesday. Housing stocks have rallied over the past three months on the prospects of lower rates and a cyclical recovery. That’s not to say that fundamentals have dramatically improved for buyers, but there are expectations that housing conditions, while weak, have troughed for the cycle. Consensus for the NAHB data point is 33, which speaks to ongoing issues with affordability and lackluster new construction.

Finally, Thursday’s Initial and Continuing Jobless Claims data, released at 8:30 am, demands attention. While weekly claims are noisy, smoothed trends can give us a lead on unemployment. Initial Claims have trended higher over the past three months, reinforcing concerns about labor market softening. Stay tuned for an eventful week.

Macro Job Board

This position will serve on the Global Macro Team. Collaborating closely with Mr. Dalio on key initiatives, this small team conducts cutting edge macroeconomic and markets research. The research directly impacts the DFO’s investments, and much of it is published externally and read by the top policymakers and thinkers globally.

This position supports the Chief Market Strategist on cross-asset macroeconomic and investment strategy research. This is an execution-focused role ideal for someone with a strong grasp of macro and markets, professional writing skills, and the technical ability to build charts, models, and client-ready content from data.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.