- Macro Monday

- Posts

- Everything You Need To Know About PMIs

Everything You Need To Know About PMIs

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 PMIs Are An Early Read On Economic Activity: PMIs are great leading indicators of future economic trends because they measure subtle changes occurring in the early stages of the economic supply chain.

🔹 PMIs Are Amongst Most Widely-Followed Series: Given it’s long and impressive track record as a gauge of future economic activity, the ISM Manufacturing Index is one of the most frequently used series to monitor the business cycle.

🔹 The ISM New Orders Subcomponent Is Particularly Useful: As the most leading subcomponent of the ISM Manufacturing Index, the New Orders subcomponent gives the earliest heads up on changes in economic activity.

🔹 PMIs Are Proxies Of Many Financial Indicators: The ISM Indices can be used as proxies for many series including the business cycle, stocks, equity leadership, volatility, yields, financial risks, and more.

🔹 ISM Manufacturing Index Is Superior To ISM Services Index: Due to its much longer history, smaller year-end revisions, and better correlation with key series, the ISM Manufacturing Index is preferred over its Services counterpart.

Get An Early Win In 2026…

We launched a 15-hour, self-paced online Macro Investing Bootcamp.

It’s the perfect way to invest in yourself to kick off 2026.

It’s completely self-paced, designed to fit into your schedule, and offers video lectures, downloadable slides, key takeaways, and practical exercises.

You’ll learn the essentials of macro investing: the forces of policy, the global backdrop, and how macro trends affect stock selection and portfolio strategy.

Macro Data Center

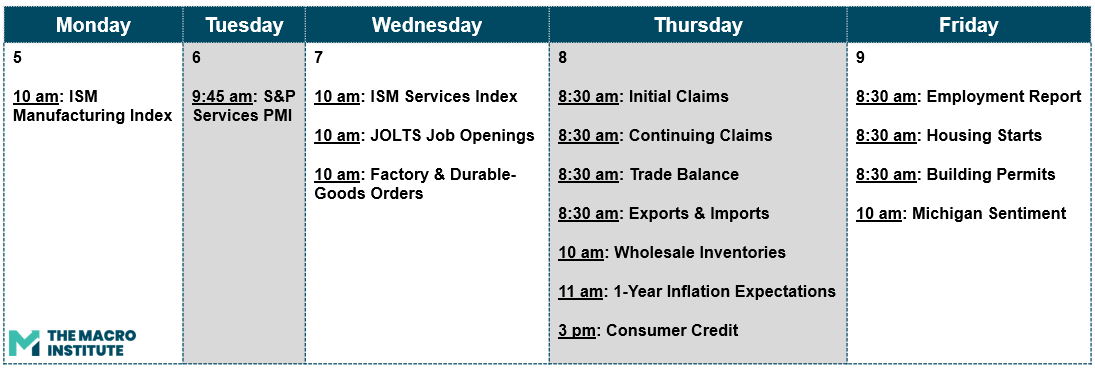

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 Housing Demand Firmed: Pending Home Sales jumped +3.3% m/m in November (+2.6% y/y), a much stronger print than expected and the highest level since early 2023. This suggests better affordability/inventory dynamics are finally showing up in activity.

🔹 Home Prices Still Rising, But Cooling: Case-Shiller (+1.4% y/y) and FHFA (+1.7% y/y) both signaled that the housing market remains cool, but has not completely rolled over.

🔹 National PMI Still In Expansion, But Slowing: S&P Global Manufacturing PMI came in at 51.8 in December (down from 52.2). The expansion continues, but momentum softened into year-end.

🔹 “No Fire, No Hire” Labor Market Continues: Initial claims fell to 199k and continuing claims eased to 1.866M. Layoffs remain low, but hiring/re-employment also remain sluggish.

🔹 Fed Minutes Highlighted Internal Debate: The FOMC minutes (Dec 9–10 meeting) underscored meaningful disagreement and a “close call” feel. The question remains whether more cuts are warranted, and if so, how many.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

Will contribute to the fixed income macro research team that produces opinions and recommendations for actively managed bond and money market portfolios. The analyst will deliver opinions and recommendations to inform portfolio duration, interest rate and asset allocation strategies across the Treasury, Corporate, and Securitized asset classes.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.