- Macro Monday

- Posts

- Explaining Our K-Shaped Economy

Explaining Our K-Shaped Economy

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 What Is A K-Shaped Economy?: It’s where higher-income Americans are seeing their incomes and wealth rise while lower-income households struggle with weaker income gains and steeper prices.

🔹 Current Economic Data Bears This Out: Consumer confidence is falling while corporate earnings are rising, the Fed is cutting rates while consumers are struggling with affordability, and wage growth is flat for higher-income households while it’s fallen for lower-income households.

🔹 Asset Owners Are Doing Well: Households that own corporate equities and real estate have experienced significant wealth increases via price appreciation since 2019.

🔹 AI Having A Marginal Impact: It’s too early to draw any definitive conclusions, but the adoption of Artificial Intelligence seems to only be exacerbating the problem.

🔹 Why It Could Matter For Markets: Consumption is the lifeblood of the U.S. economy. Any potential slowdown in consumption would have a negative impact on corporate earnings, which would in turn negatively impact the S&P 500.

Macro Data Center

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

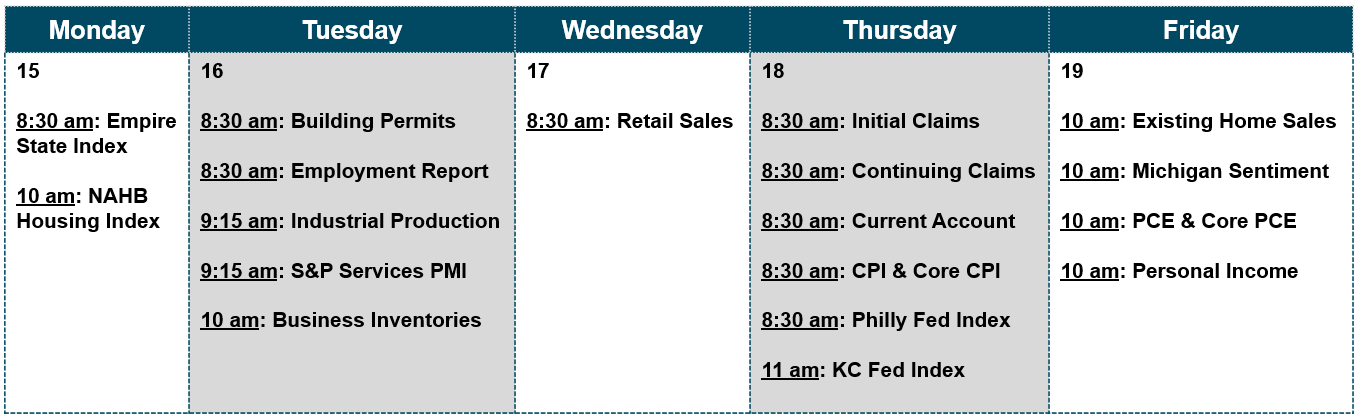

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 Broad Growth Deceleration: Services PMI slowed and multiple regional Fed surveys (Empire, Philly, KC) weakened, pointing to cooling momentum.

🔹 Labor Market Cooling Continues: November payroll growth was modest and unemployment rose, reinforcing a gradual labor-market softening.

🔹 Inflation Cooling, Signal Noisy: CPI and Core CPI surprised meaningfully lower, but shutdown-related data disruptions reduce confidence in the signal.

🔹 Consumer Slowing at the Margin: Retail sales were flat, suggesting household spending is losing momentum even as sentiment has improved modestly.

🔹 Housing Still Depressed: NAHB builder confidence ticked up slightly, but remains below neutral, highlighting affordability issues and demand constraints.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

Will contribute to the fixed income macro research team that produces opinions and recommendations for actively managed bond and money market portfolios. The analyst will deliver opinions and recommendations to inform portfolio duration, interest rate and asset allocation strategies across the Treasury, Corporate, and Securitized asset classes.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.