- Macro Monday

- Posts

- Explaining The "No Hire, No Fire" Job Market

Explaining The "No Hire, No Fire" Job Market

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 Relationship Between Hiring & Firing Has Broken Down: The traditional inverse relationship between the hiring rate and layoff rate has diverged. Companies are not hiring many people, but are hesitant to move forward with layoffs.

🔹 Overall Uncertainty Is The Main Culprit Of This Trend: Businesses and consumers both feel uncertain about their economic futures. This has sent a freeze over the labor market as companies hold still and employees are afraid to quit.

🔹 Tight Labor Markets Are Scaring Businesses: Despite the uncertainty, businesses are afraid to lay people off due to the lack of available workers. Plus, following the pandemic the reservation wage spiked as people left the workforce.

🔹 Employees Are Afraid To Quit Their Jobs: Consumers are feeling highly uncertain about the health of the U.S. economy. A majority do not think they would land a job within three months if they quit or were fired.

🔹 AI Is Adding Fuel To The Fire: The uncertainty felt by businesses and consumers is only multiplied when AI enters the equation. Businesses are quite split on whether or not AI will lead to them needing less or more employees in the future.

Miss our last few videos? No worries. Check them out below 👇

1) Understanding The Role Of Inflation In The Business Cycle

2) Should America Rebuild Its Manufacturing Base?

3) Everything You Need To Know About PMIs

Get An Early Win In 2026…

We launched a 15-hour, self-paced online Macro Investing Bootcamp.

It’s the perfect way to invest in yourself to kick off 2026.

It’s completely self-paced, designed to fit into your schedule, and offers video lectures, downloadable slides, key takeaways, and practical exercises.

You’ll learn the essentials of macro investing: the forces of policy, the global backdrop, and how macro trends affect stock selection and portfolio strategy.

Macro Data Center

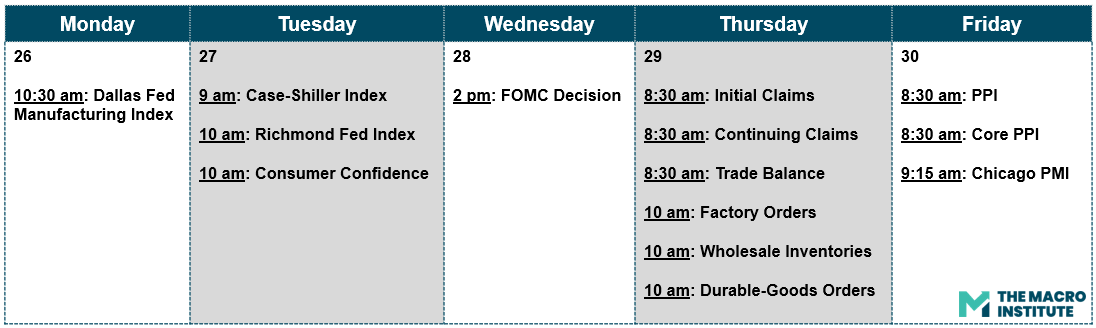

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 Consumers Kept Spending + Inflation Firmed: Personal income rose +0.3% (m/m) while spending rose +0.5%. Meanwhile, PCE inflation ran +0.2% (m/m) and 2.8% (y/y). Core PCE was also +0.2% and +2.8% m/m and y/y respectively.

🔹 GDP Came In Hotter Than Earlier Prints: The updated estimate showed real GDP running at a 4.4% annual rate in Q3 2025. The strength is largely tied to consumer spending, government spending, and investments.

🔹 PMIs Still Expanding, But Steady: S&P Global PMIs stayed in growth territory with Manufacturing at 51.9 (Dec: 51.8), Services at 52.5 (Dec: 52.5), and Composite at 52.8 (Dec: 52.7). Price pressures remained elevated in the survey.

🔹 Michigan Sentiment Slightly Improved: Consumer sentiment ticked up to a final 56.4 in January, while 1-year inflation expectations eased to 4%. This is the lowest inflation expectations number since January 2025.

🔹 “No Hire, No Fire” Still Intact: Initial jobless claims were basically unchanged at 200k, while continuing claims fell to 1.849M. Layoffs remain contained, while the broader hiring vibe is subdued.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

This role will provide economic research and insights, actively contributing to business strategy and portfolio management. The role will involve analyzing and commenting on economic data releases and policy events, producing macroeconomic forecasts, writing briefing notes, and presenting to internal and external stakeholders.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.