- Macro Monday

- Posts

- Macro Monday (12/11/23)

Macro Monday (12/11/23)

The Macro Institute's Weekly Economic Primer

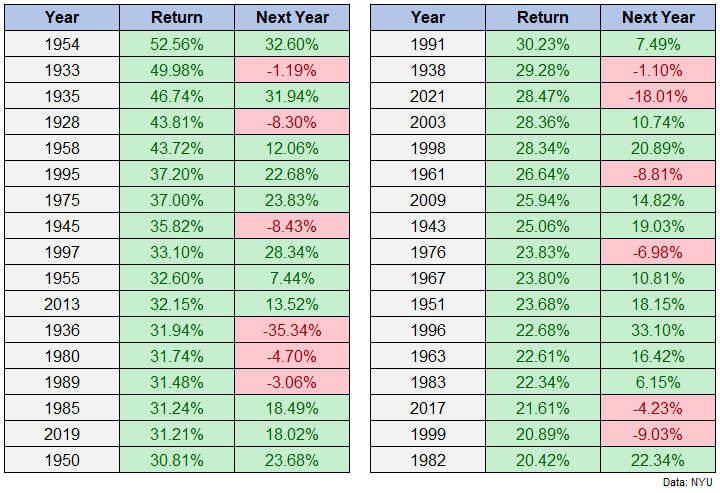

The mood in markets remains upbeat, with a slightly stronger-than-expected November U.S. employment report pushing stocks higher at the end of last week. With more evidence of falling inflation coupled with resilience – at least for now – in the growth data, investors have increased their bets that the Fed will be able to cut interest rates as soon as the first quarter of 2024. We agree as far as the timing, but we do not see any evidence that easier monetary policy will be able to ward off a recession or reverse the slow rise in unemployment and jobless claims. As the graph here shows, the Fed only tends to cut interest rates once unemployment is already on the rise. Investors hoping for rate cuts should be careful what they wish for.

The Macro Week In Review

The Macro Week Ahead