- Macro Monday

- Posts

- More Inflation Surprises Ahead?

More Inflation Surprises Ahead?

The Macro Institute's Weekly Economic Primer

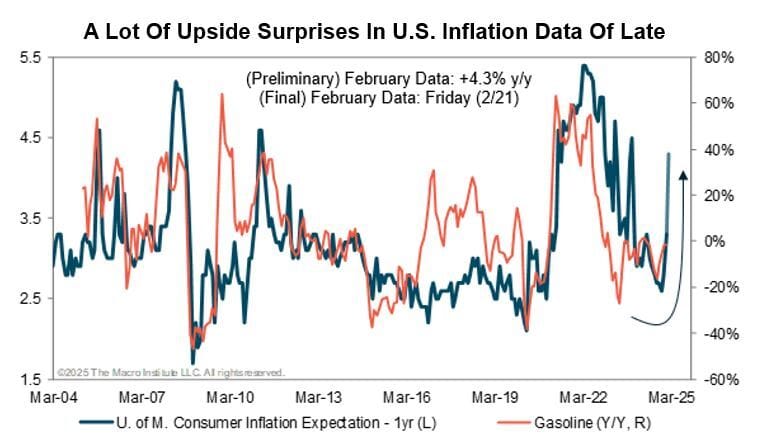

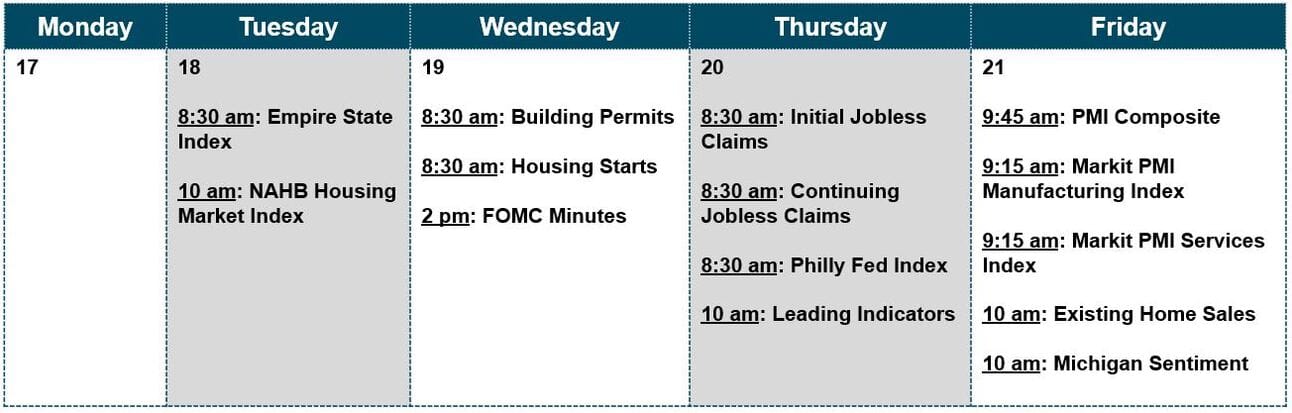

This week we get a glimpse of the first LEIs for January. Both the NAHB and the Empire Fed Index drop today, and we see preliminary numbers from the Markit survey on Friday. After last week's "less cold than expected" inflation data, we are looking forward to inflation expectations from the final Michigan Survey of Sentiment on Friday as well. The preliminary data two weeks ago was a huge inflation surprise to the upside. This series is highly influenced by gas prices, so it was a bit unusual to see it pop this much when energy prices were mostly range-bound last month. There may be something more serious brewing here, and we should all keep a close eye on inflation data going forward.

The Macro Week Ahead

Recap Of Last Week:

Last week’s data painted a concerning picture of rising inflation. Key indicators, including Core CPI, ISM Manufacturing & Services Prices, University of Michigan Inflation Expectations (1-year), and PPI, all showed an uptick in January and February. Year-over-year trends continue to run above the Fed’s 2% target, fueled by stronger Leading Economic Indicators (LEIs), a robust labor market, and less restrictive monetary policy compared to last year. This Friday, the final Michigan inflation survey for February is expected to confirm a 4.3% annual jump, up from the preliminary shock.

Despite these hot numbers, Fed Chair Jerome Powell remains firm that patience is essential to curb inflation, stressing that monetary policy is still restrictive. As a result, rate cut expectations for 2025 have dropped, and traders now expect zero rate cuts until September. Chicago Fed President Austin Goolsbee added that if inflation persists like this, the Fed’s work is far from over.

Short Week, Packed With LEIs:

With the U.S. equity market closed on Monday, Tuesday brings February’s Empire Manufacturing data at 8:30 am. While volatile, it’s worth watching after a rollercoaster of multi-year highs in November followed by sharp declines in December and January. More stable LEIs like the ISM Manufacturing Index have shown recent strength.

Other key LEIs this week include the NY Fed Services Business Activity (Wednesday), Philly Fed (Thursday), and S&P Global US Manufacturing PMI (Friday). Based on the NFIB Small Business Optimism Index, we expect continued growth in February, though month-over-month figures might cool slightly.

Housing Market ... Any Hope?:

The average U.S. 30-year mortgage rate is sitting at 6.87%, down from May’s peak of 7.22%, but still stuck at year-ago levels - leaving homebuyers struggling to remember the days of 3% rates. On Tuesday, the National Association of Home Builders (NAHB) will release February’s Housing Market Index, which is expected to dip slightly to 46 from January’s 47 number. One positive note: a key forward-looking component has surged from the mid-40s to low 60s since mid-2024, though prospective buyer traffic remains sluggish in the low 30s.

Housing starts and building permits will be reported on Wednesday, and existing home sales follow on Friday. With affordability still a major hurdle, we’re not expecting a major housing rebound anytime soon.

The Macro Specialist Designation (M2 SD)

Learn More Here: https://themacroinstitute.com/

The Macro Week In Review

Macro Job Board

Seeking a highly motivated Cross-Asset Macro Strategist to join our fast-paced and dynamic team. This is a sell-side research role designed to support the Chief Market Strategist (CMS) in delivering cutting-edge research and actionable investment strategy across multiple asset classes.

Looking for a highly qualified candidate to join our Global Macro (GM) team as Assistant Vice President / Vice President, Portfolio Manager, within the Multi-Asset Absolute Return Portfolio (MAARS). Responsible for portfolio management and return generation, with a focus on macro equity across country, sector, style, and thematic investments.

This candidate will closely monitor political and policy developments

and assist economists to publish timely and innovative research on macroeconomic, political, and policy developments and their economic impact. They will also work on economic research projects and publications.

What We Read This Weekend

Have feedback? Simply reply to this email to tell us what you like and don’t like about Macro Mondays!