- Macro Monday

- Posts

- Regional PMIs Are Telling An Important Story

Regional PMIs Are Telling An Important Story

The Macro Institute's Weekly Economic Primer

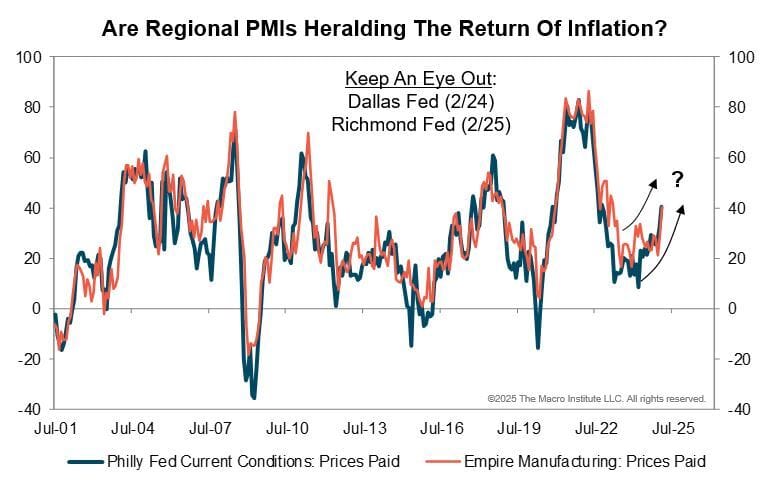

This week is packed with key data drops, including Q4 GDP and core PCE inflation. Our main focus, however, will be on the regional PMIs. Inflation signals in both the NY Fed Empire Index and Philly Fed Index skyrocketed in January - if this trend holds, it could shake up the Fed’s playbook and rattle markets. Up next: the Dallas Fed Index later this morning and the Richmond Fed Index tomorrow. We’re zeroing in on their Prices Paid components to see if last week’s inflation warning was a fluke or the start of something bigger. Time will tell.

The Macro Week Ahead

Data Recap: Signs of Growth, but Inflation Lurks:

The U.S. economy is flashing mixed signals - cyclical growth indicators are heating up, but inflation refuses to cool down. January and February saw expansion across key manufacturing gauges, including ISM Manufacturing New Orders and the S&P Global Manufacturing PMI. But housing is still in the doghouse, with the NAHB Index and Pending Home Sales missing expectations.

Inflation, however, isn’t backing down. As the chart above shows, regional PMI inflation signals have been ticking up, and the latest University of Michigan Consumer Sentiment Survey revealed inflation expectations are creeping higher at 4.3% for the next year and 3.5% over the longer term. This contradicts the Fed’s carefully curated messaging, raising questions about how much longer policymakers can keep rates steady. With capacity utilization tight at 77.8%, any growth resurgence could reignite inflation pressures.

Zooming out, the macro landscape remains a mixed bag. The Bloomberg Economic Surprise Index has stayed positive since January, propped up by a strong labor market. But inflation-sensitive sectors like retail and wholesale have underwhelmed - flipping the script from 2024’s trends.

The Week Ahead: Data Watchlist:

Today: The Chicago Fed National Activity Index (January) and Dallas Fed Manufacturing Activity (February) are released. January’s Dallas Fed number hit its highest since early 2022 - will we see a pullback, or does inflation keep creeping in?

Tuesday: Richmond Fed Manufacturing Survey - less bullish than other indicators, but it suggests cyclical growth bottoms in late 2024.

Consumer Check-In: With consumption driving 70% of GDP, all eyes are on consumer sentiment. The University of Michigan Consumer Sentiment Survey slid from 75 in December to 64.7 in February, likely thanks to rising prices on essentials like eggs, coffee, and chocolate. Inflation expectations remain politically divided.

Tuesday: Conference Board Consumer Confidence Index (February). After an election-driven surge, confidence has been slipping - will the trend continue?

Friday: The PCE Price Index (January), the Fed’s favorite inflation gauge, is on deck. Core PCE is expected at 2.6% (down slightly from December’s 2.8%) but given that CPI and PPI surprised to the upside, this one will be closely watched.

Bottom Line:

The economy is at an inflection point - growth indicators are picking up, but inflation isn't bowing out just yet. With key consumer and inflation data on tap, the next few days could set the tone for the Fed’s next move. Stay tuned!

The Macro Specialist Designation (M2 SD)

Learn More Here: https://themacroinstitute.com/

The Macro Week In Review

Macro Job Board

Seeking a highly motivated Cross-Asset Macro Strategist to join our fast-paced and dynamic team. This is a sell-side research role designed to support the Chief Market Strategist (CMS) in delivering cutting-edge research and actionable investment strategy across multiple asset classes.

Looking for a highly qualified candidate to join our Global Macro (GM) team as Assistant Vice President / Vice President, Portfolio Manager, within the Multi-Asset Absolute Return Portfolio (MAARS). Responsible for portfolio management and return generation, with a focus on macro equity across country, sector, style, and thematic investments.

This candidate will closely monitor political and policy developments

and assist economists to publish timely and innovative research on macroeconomic, political, and policy developments and their economic impact. They will also work on economic research projects and publications.

What We Read This Weekend

Have feedback? Simply reply to this email to tell us what you like and don’t like about Macro Mondays!