- Macro Monday

- Posts

- Should America Rebuild Its Manufacturing Base?

Should America Rebuild Its Manufacturing Base?

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 The Early 2000s Were The Perfect Storm: The combination of China entering the WTO in 2001, cheap money across the globe following deep U.S. interest rate cuts, and China’s booming working-age population created the perfect environment for companies to start offshoring their manufacturing to China.

🔹 America’s Manufacturing Losses Were Technology Gains: While the U.S. began to fall behind in areas such as auto manufacturing, offshoring these capabilities freed up the energy, time, and capital required to build out America’s enormous technology industry. Would you trade GM for Silicon Valley?

🔹 This Dynamic Changed Once Covid-19 Hit: This tradeoff was working well… until it wasn’t. Supply chain disruptions caused by the Covid-19 pandemic had many companies reconsidering their manufacturing relationships for the first time. Should they re-shore? Diversify? “Near-shore”?

🔹 Common Arguments For Reshoring Are Weak: Arguments that manufacturing is good for jobs or drives productivity are not strong. The manufacturing sector is too small for marginal increases to have a huge impact on the labor market (plus, automation likely further dulls the impact), and the U.S. has outperformed every other economy during the same period in which its manufacturing sector cratered.

🔹 Developing A Framework To Answer This Question: When considering whether or not America should pursue manufacturing capabilities in a certain area we should consider the monopolization risk of that area, the flexibility of that manufacturing capacity, whether or not that capacity is critical for future technologies, and the opportunity cost of developing that capacity.

This video was heavily inspired by Chris Miller’s Does Manufacturing Matter?

Get An Early Win In 2026…

We launched a 15-hour, self-paced online Macro Investing Bootcamp.

It’s the perfect way to invest in yourself to kick off 2026.

It’s completely self-paced, designed to fit into your schedule, and offers video lectures, downloadable slides, key takeaways, and practical exercises.

You’ll learn the essentials of macro investing: the forces of policy, the global backdrop, and how macro trends affect stock selection and portfolio strategy.

Macro Data Center

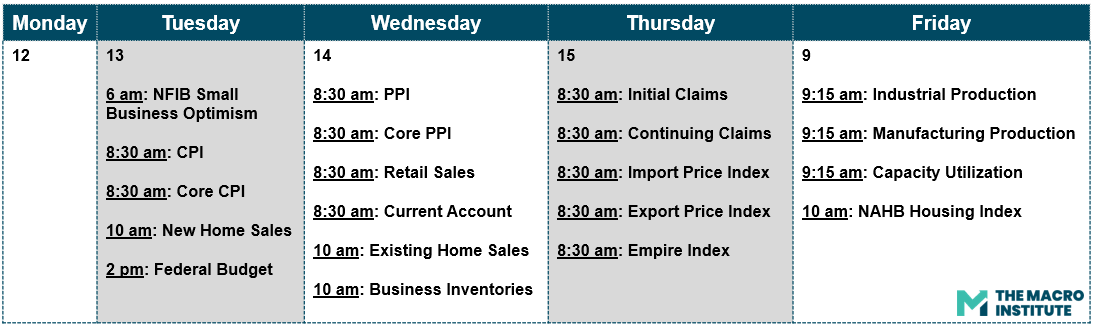

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 ISM Manufacturing PMI Stayed in Contraction: The ISM Manufacturing Index fell to 47.9 in December (from 48.2), marking 10 straight months of contraction. New Orders stayed weak at 47.7.

🔹 ISM Services PMI Reaccelerated: The ISM Services Index jumped to 54.4 in December (from 52.6), while New Orders surged to 57.9 and Employment moved back into expansion at 52.

🔹 Trade Deficit Narrowed Sharply: The goods & services trade deficit shrank to $29.4B in October 2025 (down $18.8B). Exports rose to $302.0B (+$7.8B) while imports fell to $331.4B (-$11B).

🔹 Inflation Expectations Ticked Up: In the NY Fed’s Survey of Consumer Expectations, 1-year-ahead inflation expectations rose to 3.4% (up from 3.2%), while 3-year and 5-year expectations both held steady at 3%

🔹 Michigan Sentiment Improved: Consumer sentiment in the preliminary Michigan Sentiment report for January rose to 54.0 (from 52.9). Year-ahead inflation expectations held at 4.2%, and long-run expectations ticked up to 3.4%.

Start your year with clarity

Written by Shane Parrish and reMarkable, this workbook helps you reflect without complexity or stress. It guides you through the past year with intention, so insights emerge naturally.

This isn’t about setting more goals. It’s about understanding what matters, clearly and calmly.

A simple reset for January. A thoughtful way to review your year.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

This role will provide economic research and insights, actively contributing to business strategy and portfolio management. The role will involve analyzing and commenting on economic data releases and policy events, producing macroeconomic forecasts, writing briefing notes, and presenting to internal and external stakeholders.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.