- Macro Monday

- Posts

- So Are We Done With The Rate Cuts?

So Are We Done With The Rate Cuts?

The Macro Institute's Weekly Economic Primer

The process of normalizing economic data post-shutdown continues this week, and all eyes will be on November payrolls dropping Tuesday. In recent months, several studies have highlighted a sharp decline in the “breakeven” payroll rate. This is the number of jobs needed to keep the unemployment rate steady. The math behind this is not super simple, but most studies point to immigration policy as the key driver.

At this stage, according to the St. Louis Fed, any monthly payroll gain above roughly 30,000 could now lower the unemployment rate! This is pretty wild. Don’t be surprised if we see some unusual stats this week.

We’ll also get the first read on regional activity, with the Empire Fed Index out Monday, followed by the Philly Fed and Kansas City Fed indices on Thursday.

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

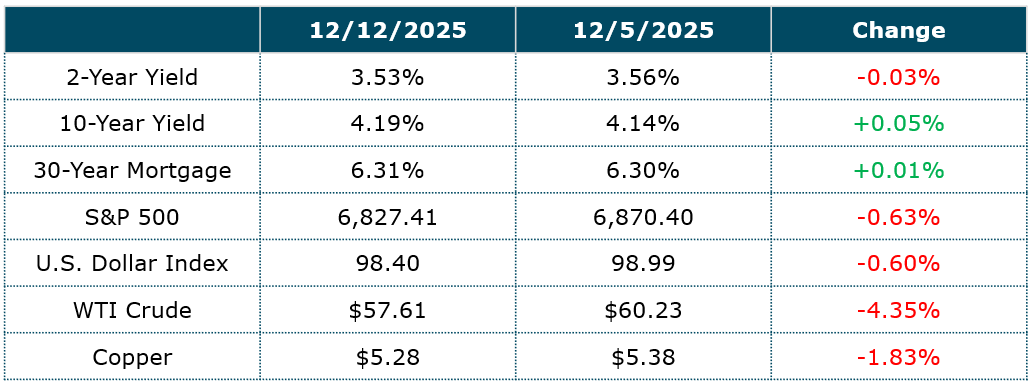

The Macro Week In Review

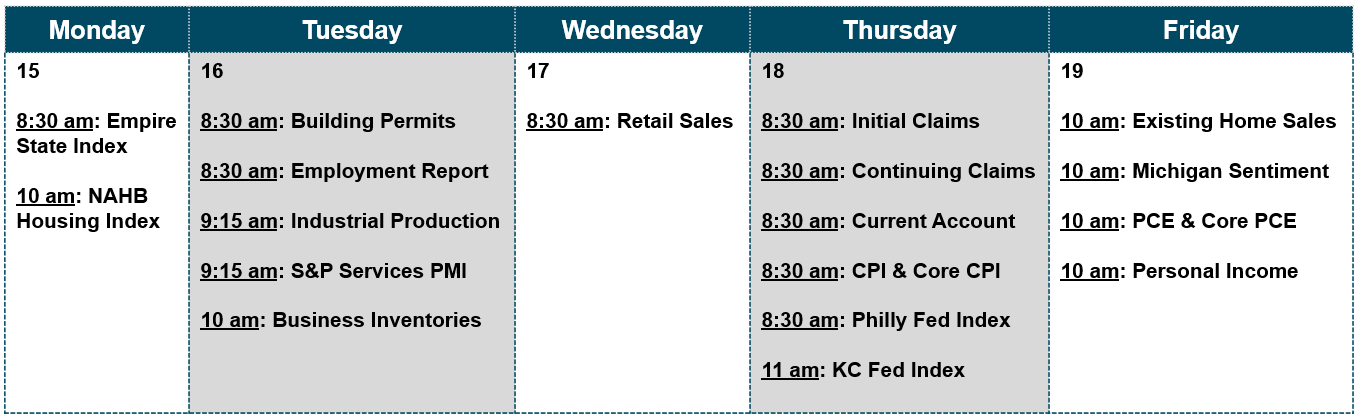

The Macro Week Ahead

🔬 Deciphering The Fed-Speak

Last week, the Fed delivered another 25-bps rate cut, bringing total easing since 2024 to 175 bps. Policymakers continue to frame labor-market softening as a larger threat to economic stability than above-trend inflation. However, there are a few important nuances worth highlighting.

On labor markets, the Fed believes the monthly pace of job creation required to keep the unemployment rate steady has fallen meaningfully since 2024. This is largely due to immigration-driven labor-supply dynamics. Chairman Powell referenced an estimate that BLS payrolls may be overstated by roughly 60k per month. If that’s correct, headline job gains averaging ~40k since April are effectively closer to –20k, which represents a materially weaker backdrop than the current top-line numbers imply.

On inflation, the Fed believes that if you strip out the effects of tariffs, then underlying inflation is running in the “low twos.” In the Fed’s view, that sets inflation on a relatively pre-determined path back toward 2% by the end of Q1 2026. Notably, despite forward-looking indicators suggesting employers are still struggling to source qualified workers, officials continue to treat wage pressure as a non-issue. This is an interesting stance given their emphasis on immigration’s role in labor supply.

Powell also suggested policy is now roughly neutral. That points to a more patient, data-dependent posture heading into this week’s release of the delayed November employment report. The Fed’s hope is that this year’s 75 bps of easing helps arrest the deterioration in employment without reigniting inflation.

The latest Summary of Economic Projections (SEP) still penciled in one additional 25 bps cut in 2026, even as GDP forecasts were revised higher from 1.8% to 2.3%. Markets currently price a 77% probability of no change at the January 27 meeting. Odds of an additional cut start to rise heading into March and April.

With Chairman Powell’s term nearing its end, the President’s eventual choice of successor, and the perceived policy lean of that nominee, could become a meaningful driver of rate expectations.

📆 The Week Ahead

This week is a busy one!

Monday brings the Empire State Manufacturing Survey, one of the more bullish (though volatile) regional PMIs. For the 2026 outlook, the inflation path remains crucial, and Empire’s prices paid component is still sitting at a post-tariff cyclical high. That’s a signal worth watching, as it suggests near-term upward pressure on CPI. We’re also watching the regional employment components. Evidence remains limited, but there are early hints labor conditions may be approaching a bottom.

Monday also brings the NAHB Housing Index. Normally a reliable leading indicator, its signal this cycle is constrained by mortgage rates that remain ~200 bps above levels typically consistent with a recovery in purchase applications.

Tuesday is the main event. The long-awaited November Employment Report is released at 8:30 am. Consensus calls for a 50k payroll gain, but adjusting for the Fed’s implied revision would put job growth closer to flat. The unemployment rate is expected to tick up 10 bps to 4.5%, though that estimate hinges heavily on assumptions around population growth, labor-force participation, and participation trends. Structural forces such as immigration, retirements, and disability-related exits could create a world where job growth is soft, but the unemployment rate stays sticky.

Thursday brings November CPI. Headline inflation is expected at 3.1% year-over-year, with Core CPI staying steady at 3.0%. Goods inflation is expected to keep accelerating due to tariffs, which is something the Fed appears willing to look through given the potential for a disinflationary reversal starting in early 2026. Pay particular attention to rent, which the Fed views as a natural source of disinflation over time, as rents tend to follow the pace of new home prices with a short lag.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

In this role, you will serve as the sole G10 FX strategist based in our NYC office, working in close collaboration with your counterparts in the UK. You will monitor and review global macroeconomic developments, central bank policies, and geopolitical events, and translating these insights into actionable FX strategies.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.