- Macro Monday

- Posts

- The Fed Cut Rates ... What Comes Next?

The Fed Cut Rates ... What Comes Next?

The Macro Institute's Weekly Economic Primer

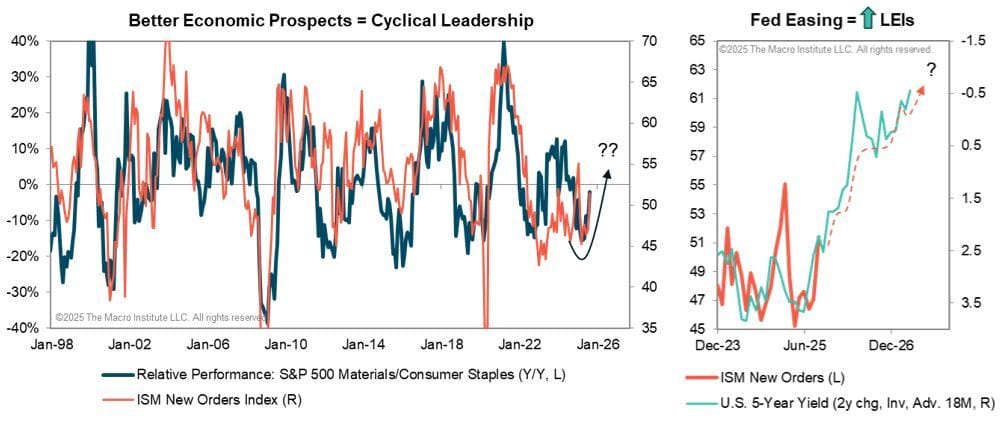

There's plenty of potential market-moving data on deck this week. We’ll get a series of LEI readings for September, starting with the Richmond Fed Manufacturing Index on Tuesday, and followed by the KC Fed Manufacturing Index on Thursday. Together, these should hint at what the broader ISM release may say about market leadership.

Beyond that, keep an eye on New Home Sales on Wednesday, and most importantly, the Core PCE Deflator on Friday, which is the Fed’s preferred inflation gauge. This release has the potential to shift market expectations in a meaningful way.

The Macro Week In Review

Earn your PE certificate online. Build an MBA-style network.

The Wharton Online + Wall Street Prep Private Equity Certificate Program gives you the knowledge and tools top professionals use to analyze investment opportunities.

Learn from senior leaders at top firms like Carlyle, Blackstone, and KKR.

Get direct access to Wharton faculty in live office hours where concepts become clear, practical, and immediately applicable.

Study on your schedule with a flexible online format

Plus, join an active network of 5,000+ graduates from all over the world.

Enroll today and save $300 with code SAVE300 + $200 with early enrollment by January 12.

Program begins February 9.

The Macro Week Ahead

📈 Buying Puts On The Economy

As expected, the Federal Reserve lowered interest rates by 25 bps last week, with two more cuts anticipated by year end. The Chairman’s remarks largely met expectations: upside risks to inflation and downside risks to employment. When the Fed’s dual mandate diverges, the task falls to its forecasting ability to judge which risk poses the greater threat and steer policy accordingly. Right now, the Fed views labor market weakness as the primary concern, which explains both last week’s cut and the dovish guidance into year end.

Still, the Chairman framed the move as a “risk management cut,” suggesting looser policy could cushion against a sharper downturn in employment and growth while emphasizing that conditions do not yet warrant the aggressive easing path currently implied by financial markets.

This nuance makes the Fed’s actions and projections somewhat inconsistent. Compared to June’s forecasts, real GDP growth for 2025 was revised up to 1.6% (from 1.4%) and the unemployment rate held steady at 4.5%. Notably, the Fed doesn’t see inflation reaching its 2.0% target until 2028. Investors are left reconciling a dovish tilt in policy with projections that lean hawkish.

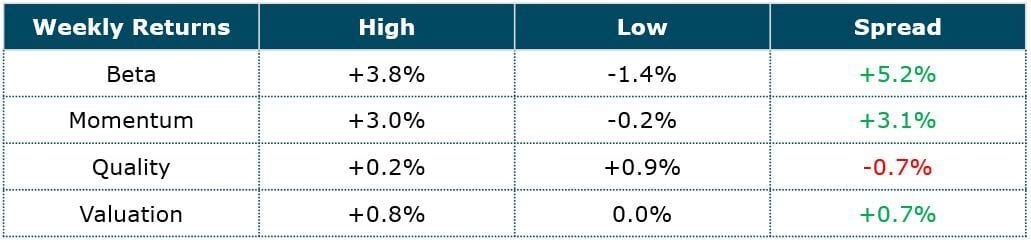

Markets, however, took the cuts positively. Equities rallied broadly into the week’s end. The 10-year Treasury yield initially fell sharply on the announcement but then reversed higher on the back of the Chairman’s comments and stronger-than-expected Initial Claims data. In the near term, a string of firm economic reports could push yields higher from April’s lows and pressure equities as odds of deeper cuts fade. For now, stocks appear inclined to follow stimulus upward.

📆 The Week Ahead

Attention turns to August and September trends on Tuesday with preliminary September S&P Global PMI data. August readings for both manufacturing and services sat in the mid-50s despite bearish tariff-related commentary. Philly Fed data for the month, while choppy, surprised sharply to the upside, underscoring that uncertainty and labor supply remain the primary constraints on capacity utilization.

Also on Tuesday, Richmond Fed data will be released, where results have lagged other regionals and the ISM/PMI benchmarks. These leading business cycle indicators continue to climb in step with the interest rate path of the last 18 months, and we expect momentum to persist through the year-end.

On Wednesday and Thursday, the focus shifts to housing with Building Permits and Existing & New Home Sales. A key leading gauge, the NAHB Index, remains depressed as affordability is the main drag. Home prices are part of the story, but mortgage rates carry more weight. Mortgage rates have fallen roughly 100 bps since January, now ~6.4%, which is their lowest since 2022 and down from an 8% peak in late 2023. While the 200-bps retreat may support some activity, many homeowners remain locked into 3% - 4% mortgages, which limits turnover. Survey data suggests a move to 4% - 5% rates would be needed before a meaningful housing recovery takes place.

Macro Job Board

This position will serve on the Global Macro Team. Collaborating closely with Mr. Dalio on key initiatives, this small team conducts cutting edge macroeconomic and markets research. The research directly impacts the DFO’s investments, and much of it is published externally and read by the top policymakers and thinkers globally.

In this role, you will serve as the sole G10 FX strategist based in our NYC office, working in close collaboration with your counterparts in the UK. You will monitor and review global macroeconomic developments, central bank policies, and geopolitical events, and translating these insights into actionable FX strategies.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.