- Macro Monday

- Posts

- Understanding The Role Of Inflation In The Business Cycle

Understanding The Role Of Inflation In The Business Cycle

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 Investors Were Unfamiliar With Inflation: The spike in inflation following Covid, and its general stickiness since, has held massive mindshare amongst investors. This is because for the last 40 years inflation has been a nonevent, so investors were largely untrained in how to handle an inflationary backdrop.

🔹 There Are Many Different Ways To Measure Inflation: CPI, PPI, PCE, and Prices Paid are all popular ways to measure inflation. Each of these metrics offer a unique perspective into price changes. Most inflation metrics also offer a Core series, which removes food and energy prices from the calculation.

🔹 Energy Packs A Big Punch In Inflation Metrics: Despite only making up 6% of the CPI basket, energy’s volatility makes it the main driver of trends in the index. This makes Headline CPI incredibly sensitive to changes in oil prices.

🔹 Inflation Has A Big Influence On Economic Growth: A rise in commodity prices, mainly via its impact on the consumer, eventually becomes a headwind for the economy. In due time, a slowdown in economic prospects will ensue and result in lower commodity prices, setting the stage for the next recovery.

🔹 Inflation Is Half Of The Fed’s Mandate: The Fed uses rate hikes to control elevated inflation or mitigate inflation risks. This helps to explain the tight relationship between the fed funds rate and CPI going back 50 years.

Miss our last few videos? No worries. Check them out below 👇

1) Should America Rebuild Its Manufacturing Base?

2) Everything You Need To Know About PMIs

3) Explaining Our K-Shaped Economy

Get An Early Win In 2026…

We launched a 15-hour, self-paced online Macro Investing Bootcamp.

It’s the perfect way to invest in yourself to kick off 2026.

It’s completely self-paced, designed to fit into your schedule, and offers video lectures, downloadable slides, key takeaways, and practical exercises.

You’ll learn the essentials of macro investing: the forces of policy, the global backdrop, and how macro trends affect stock selection and portfolio strategy.

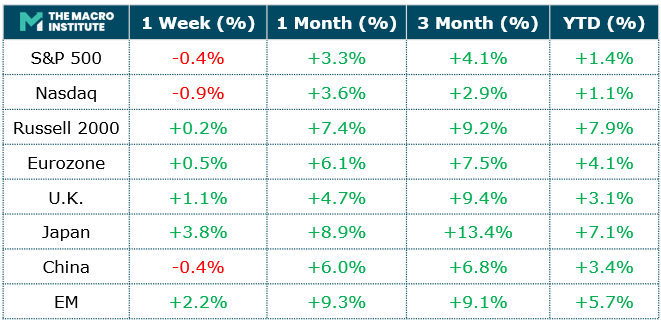

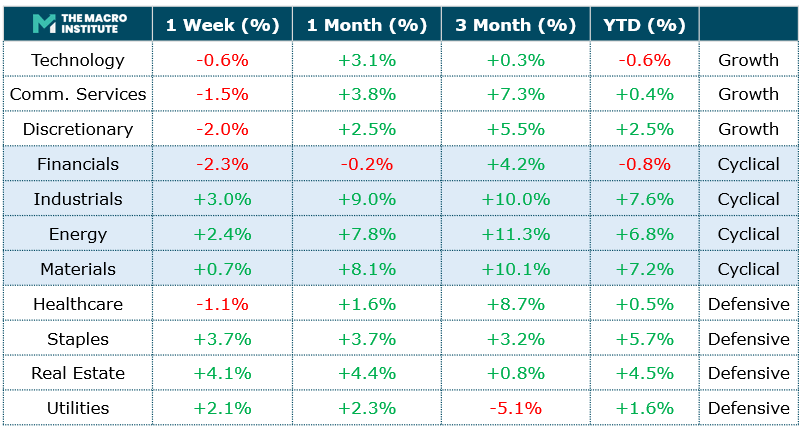

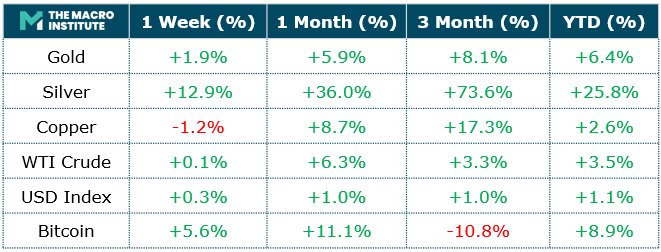

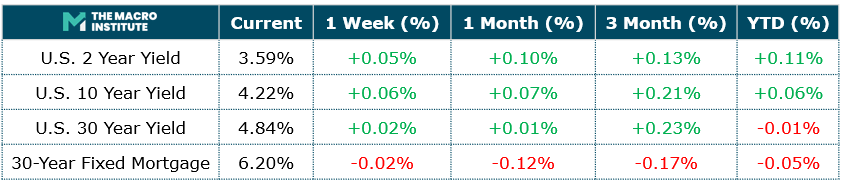

Macro Data Center

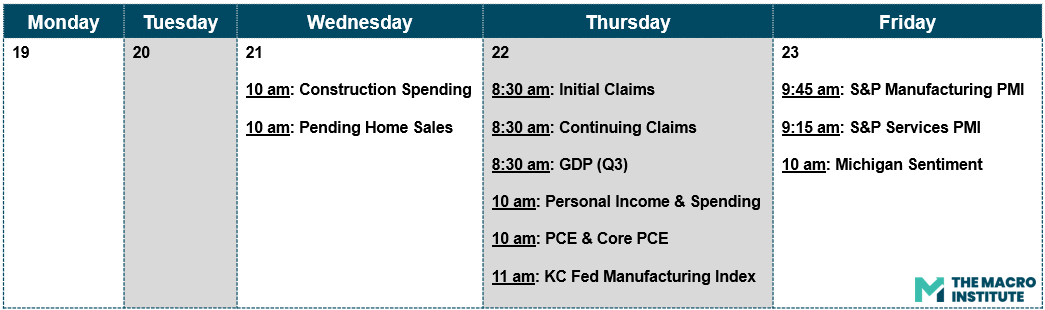

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 NFIB Optimism Rose & Uncertainty Fell: The NFIB Small Business Optimism Index ticked up to 99.5 in December (+0.5), staying above its long-run average. The Uncertainty component dropped 7 points to 84 (lowest since June 2024).

🔹 CPI Held Relatively Steady: Headline CPI rose +0.3% m/m in December and held at +2.7% y/y. Core CPI rose +0.2% m/m and +2.6% y/y. Questions remain about the quality of inflation data following the government shutdown.

🔹 “Low Fire, Low Hire” Job Market Continues: Initial claims fell to 198k, while continuing claims dipped to 1.884M. As a whole, layoffs remain contained even as hiring momentum has softened.

🔹 Homebuilders Are Still Pessimistic: The NAHB Housing Market Index fell to 37 in January (21st straight month below 50). Buyer traffic remained very weak at 23, reinforcing that affordability is still weighing on housing activity.

🔹 Federal Budget Deficit Jumped: The U.S. Treasury posted a $145B December deficit, driven by heavy outlays. Fiscal impulse and higher rates continue to make “solving the fiscal issue” incredibly difficult.

Automation Isn’t A Strategy

Financial tools promise clarity, but many leaders still don’t trust the numbers they’re seeing.

The real villain isn’t AI.

It’s relying on automation without judgment, context, or accountability.

The Future of Financial Leadership: Why AI Isn’t Enough is a free guide that explores why growing companies need more than dashboards. They need experienced guidance alongside their tools.

BELAY Financial Solutions provide that partnership: AI-fluent, U.S.-based Financial Experts who bring strategy, clarity, and confidence to every decision.

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

This role will provide economic research and insights, actively contributing to business strategy and portfolio management. The role will involve analyzing and commenting on economic data releases and policy events, producing macroeconomic forecasts, writing briefing notes, and presenting to internal and external stakeholders.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.