- Macro Monday

- Posts

- What The Fed's Rate Cuts Really Mean For The Economy

What The Fed's Rate Cuts Really Mean For The Economy

The Macro Institute's Weekly Economic Primer

Don’t have time to watch the whole video? Here’s 5 Key Takeaways:

🔹 Interest Rates Leads Economic Activity With Long Lag: It generally takes ~18 months before for the economy to start to feel the impact of changes in interest rates. The fed starting cutting rates 15 months ago.

🔹 Housing Is The Initial Mechanism Of Economic Impact: When rates fall, potential homebuyers start looking for homes. Researching, visiting homes, making offers, getting a mortgage, and moving takes time.

🔹 Homebuyers Spend More Than Non-Homebuyers: Homebuyers typically spend an extra ~$5,000 in the year they purchase a home compared to non-homebuyers. This spending is largely from appliances, furniture, repairs, and alterations.

🔹 Everything Starts With Monetary Policy: The Federal Reserve sets the fed funds rate, and interest rates can be used interchangeably for forecasting purposes since they generally trend in the same direction.

🔹 Interest Rates Are The Premier Forecasting Tool: The part of interest rates lays the foundation for future trends in LEIs (including the S&P 500!). Their ability to give a heads up on the business cycle makes them an invaluable tool for macro forecasters.

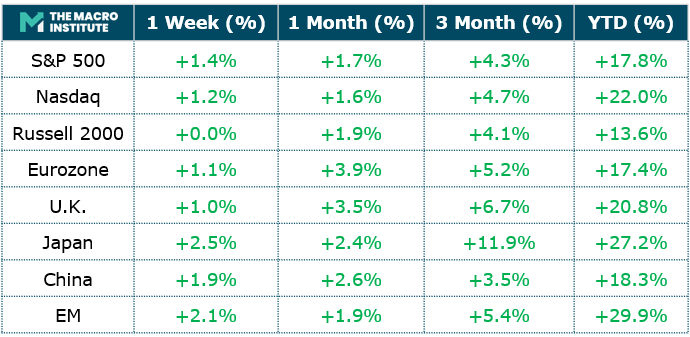

Macro Data Center

Invest right from your couch

Have you always been kind of interested in investing but found it too intimidating (or just plain boring)? Yeah, we get it. Luckily, today’s brokers are a little less Wall Street and much more accessible. Online stockbrokers provide a much more user-friendly experience to buy and sell stocks—right from your couch. Money.com put together a list of the Best Online Stock Brokers to help you open your first account. Check it out!

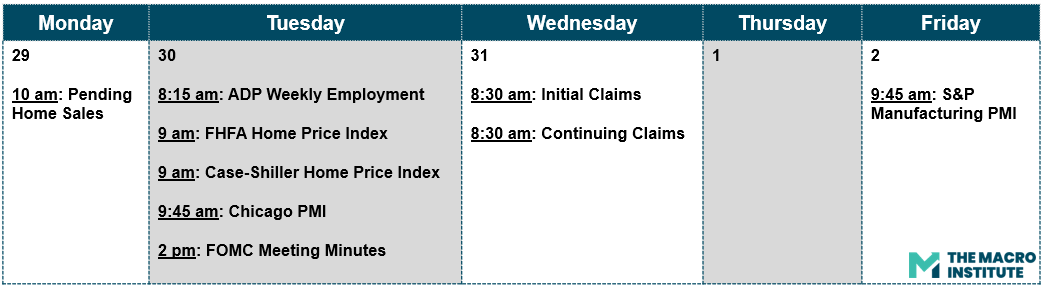

The Macro Week Ahead

📆 Last Week’s Data Key Takeaways

🔹 Firm Growth Momentum: Q3 GDP printed 4.3% (well above consensus), though it reflects earlier-quarter strength, delayed reporting, and increasing health care costs.

🔹 Manufacturing Remains Soft: Industrial production rose modestly, but factory output was flat and regional surveys (e.g., Richmond) remain in contraction territory.

🔹 Consumer Caution Continues: Confidence fell to 89.1, and expectations stayed at levels historically associated with elevated recession risk.

🔹 A “No Fire, No Hire” Labor Market: Initial claims suggest low layoffs (214k), but continuing claims rose, pointing to slower re-employment/hiring.

🔹 Business Capex Signals Mixed: Headline durable goods were weak (-2.2%), but the core capex proxy rose (+0.5%) and shipments improved (+0.7%).

Macro Job Board

Analysts will closely monitor political and policy developments, assist in publishing timely and innovative research on macroeconomic, political, and policy developments, and work with colleagues in sales and trading and investment banking, as well as clients, to answer questions and explain the team's views.

Will contribute to the fixed income macro research team that produces opinions and recommendations for actively managed bond and money market portfolios. The analyst will deliver opinions and recommendations to inform portfolio duration, interest rate and asset allocation strategies across the Treasury, Corporate, and Securitized asset classes.

You will be partnered with our senior analysts and traders to assist in identifying investment opportunities in the equity, index, and options markets. You will learn to perform in-depth company analysis around future catalyst events and provide real-time opinions on breaking news throughout the trading day.